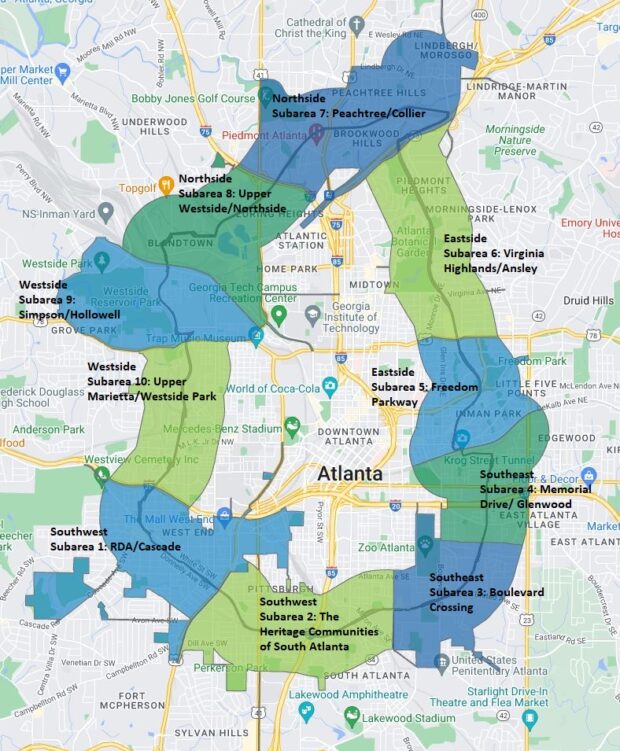

Last fall, Atlanta Beltline, Inc. enlisted our team to research the value of outdoor space to assist with their land licensing operations. We posed the question of how outdoor space is used and valued to dozens of property owners and brokers. The responses are consistently inconsistent but when viewed together, certain themes and methods emerged from the confusion.

Last fall, Atlanta Beltline, Inc. enlisted our team to research the value of outdoor space to assist with their land licensing operations. We posed the question of how outdoor space is used and valued to dozens of property owners and brokers. The responses are consistently inconsistent but when viewed together, certain themes and methods emerged from the confusion.

Baked into the indoor rate

The most common method cited for valuing outdoor space is: the value is just “baked into the rate” being charged for the accompanying indoor space. While blunt, this method is simple and straightforward. It eliminates debates/negotiations surrounding usability of and seasonal access to outdoor spaces. The flaws with this method are apparent if one considers two locations, identical except for the inclusion of a large patio with one and no patio with the other. If priced equally, we believe 100% of tenants/buyers would choose the space with the patio. The other flaw with this method becomes apparent when the indoor space and the outdoor space are owned/operated by two separate and disinterested parties.

50% of the value of indoor space

Another commonly cited method for valuing outdoor space is: 50% of the value of the accompanying indoor space. This method is attractive since it is a) simple, b) less blunt than the “baked in” method, and c) ascribes a real, tangible baseline value to something that we inherently know is valuable. While commonly cited, we have been unable to observe this method being explicitly employed by the Atlanta market. Using the 50% method, we have been able to extrapolate lease rates within market ranges found within the Eastside and Southeast Trail Corridors. We believe this method can be a useful guidepost in combination with corridor segment medians and averages but is not a relevant stand alone guide.

Application of a market capitalization rate to the value of the land

The final method for valuing outdoor space in lease transactions is to establish a value for the land, apply a market cap rate to the land value to establish an annual net operating income (NOI) and then divide the NOI by the square footage of the land to obtain the market triple net value per square foot of land. In theory, this is an appealing and academically sound method since it is agnostic as to the value of adjacent buildings and can be utilized for land without adjacent buildings. The challenges with this approach are: 1) the number of assumptions in the value of land make it highly subjective; 2) the magnifying effect that density or FAR has on the land value equation; 3) the high volatility inherent in land prices due to the cyclical nature of the real estate market.

Per Karl Case, the formula for calculating the value of land is as follows:

Lf = [(Rf-Of)]/r – Cf] * S/L

Lf is the value of land per square foot

Rf is the expected annual gross rent per square foot

Of is the annual operating costs and taxes per square foot

r is an appropriate capitalization rate

Cf is the full cost of construction per square foot, excluding land

S is the total number of rentable square feet of space

L is the size of the land parcel to be developed in square feet

S divided by L is the floor area ratio, or FAR

By adjusting certain assumptions to reflect market segment and removing the compounding aspect of FAR/density to adjust for single-story retail uses, we believe that the market capitalization method can be a useful guidepost for evaluation of future land leasing/licensing transactions.

The path forward

“The heterogeneity of land is extraordinary. The value of land is really the value of the bundle of rights and the set of neighborhood characteristics that are attached to it, which include accessibility, amenity, access to schools, environmental quality, crime, and neighbors. As development proceeds over time the best locations are developed first. Ricardo‘s description and model of how land rent rises explicitly assumes that the best land will be used to capacity before lower quality parcels are brought under till or developed. This assumption makes current raw land sales a somewhat suspect guide to the value of land under previously developed real estate. – Karl Case, 1999

Pricing of $2.00 – $3.00 /SF for storage is the lower end of the ranges we observed throughout the city. This is the price range we see in industrial storage transactions. Intown industrial storage is a very hot market due to the scarcity of appropriately zoned and accessible land so prices are fluctuating and vary widely.

Depending on attributes, we believe rates for F&B and revenue generating outdoor spaces should be in the range of 25-50% of comparably located retail building space. The reason for the wide range is to reflect the fact that the outdoor space is far less valuable without its adjacent building owner/operator’s revenue generating apparatus.

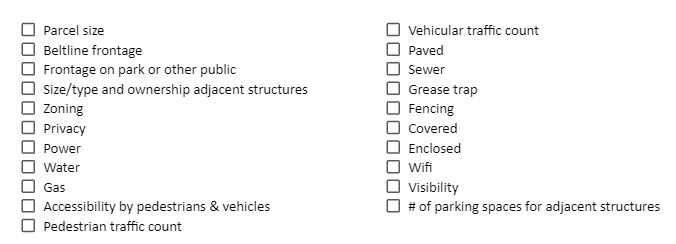

We recommend that anyone interested in valuing outdoor space begin by developing an “attribute inventory” of each parcel being considered for licensing/leasing to serve as a framework for evaluating highest and best use for the particular land asset. Below are certain attributes observed by our team and/or described by respondents who we questioned.

Once each asset’s attributes are identified and properly exposed to the market for outdoor space leasing, property owners can gauge demand signals and combine this intelligence with market rental rates for comparable indoor/outdoor spaces to appropriately price lease rates for specific assets.

Fair market value means the price at which property would change hands between a willing buyer and a willing seller, neither being under any compulsion to buy or sell and both having reasonable knowledge of relevant facts.

– United States vs Cartwright

The Beltline’s recent experiment with leasing shipping container spaces near Old Fourth Ward’s skatepark is proof of the high demand for high-traffic retail locations. Our team suspects that there is still a considerable knowledge gap about the marketplace for outdoor space along the Beltline whether it be for industrial storage, outdoor leisure or high-volume retail use.

The leasing activity reports for retail building space in the Westside and Southwest Beltline Corridor segments indicate lower than average market rental rates and higher than average marketing times for absorption (relative to other Beltline corridors). Many of these areas serve historically disenfranchised communities, whose neighborhoods are still suffering from what Karl Case characterizes as a “negative implicit value of land” when it comes to retail projects since high cost of construction combined with low market rental rates do not justify new retail development. Special consideration or subsidies should be crafted to develop the critical mass of consumer traffic and/or establish a large enough variety of vendors needed to create viable marketplaces.

Karl Case: The value of land in the United States 1975-2005

Certified Commercial Investment Member (CCIM) Forums: Retail lease rates for outdoor spaces, Yard space leasing

Bigger Pockets Podcast Forum: What to charge for a restaurant patio?

Property Week: The real value of outdoor space