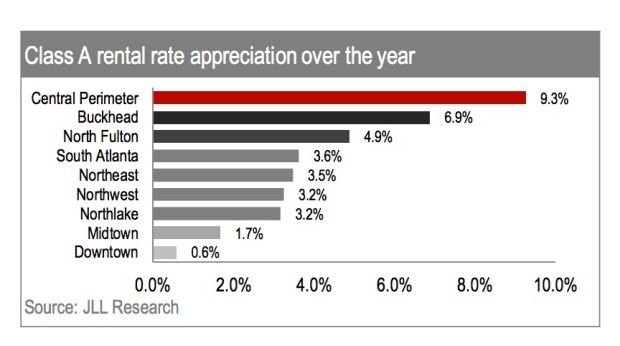

Jones Lang Lasalle gives consumers a captivating insight into the Atlanta office market rental rates over the past quarter (Q4) and more importantly, where it may be going in the future. LaSalle notes that asking rates over the last two decades have increased by an average of only 0.6 percent, but in the past year rates have soared up to 5.2 percent. What is equally as interesting is where this is occurring. Virtually all of the sub-markets saw some level of increase. This trend is not subject to only new and expensive inventory, but also landlords of existing buildings are jumping in on Atlanta’s recent supply-demand disparity. LaSalle also expects rates to continue moving in this manner over future quarters, leaving tenants to write bigger checks.

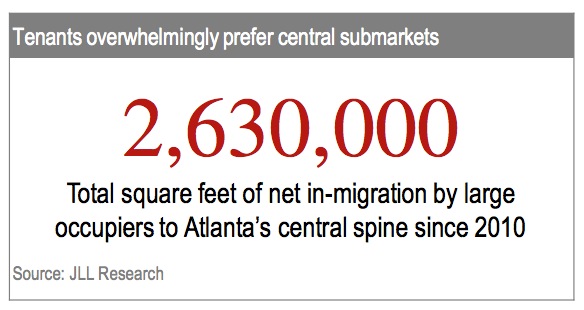

Jones Lang LaSalle says one reason for the migration to the Central Perimeter is because firms are paying more for locations with both easy access to interstates for Cobb and Gwinnett residents, and connectivity to public transit for in-town residents. This is a large factor in helping firms increase there hiring pool. Current tenant requirements for office space suggest this course of action is probably going to continue.

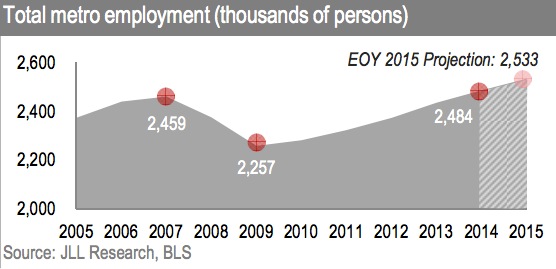

The 2015 employment projections underwrite office market trends. When employers feel confident enough to add jobs, net absorption follows. Additions occuring recently to the office- using sectors for professional business services, financial activities, and information have underwritten expectations for the Central Perimeter, Buckhead and North Fulton vacany declines. Some trends incidcate that metro vacany rates will drop another percentage point and a half over the next 12- month period, possibly ending 2015 with a seven-yer low of 18.3 percent. Only time will tell.

Information is provided by Jones Lang LaSalle. All data is deemed reliable but not guaranteed.