Jones Lang Salle came out with a Q3 summary of economic and real estate market conditions for metro Atlanta. The report includes key market indicators, tenant and landlord perspectives, and forecast. Click here to see JLL Atlanta Research Page.

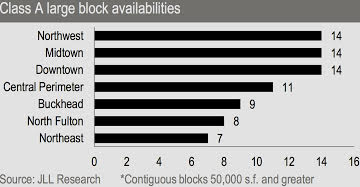

“After 4 years of dismal growth in Atlanta’s office market, there is finally a light at the end of the tunnel. The third quarter will be the last term of this seemingly everlasting dry spell. Big projects such as Ponce City, Avalon’s 5000 & 6000 and Buckhead Atlanta are currently right below 80.0% pre-leased and will be the backbone of year end absorption figures. The three in total will dish out a helpful 788,000 SF in the 4th quarter. Also, active tenant requirements for space in Atlanta are solid and approximate to 7.4 million square feet. Demand has especially risen in the Central Perimeter, North Fulton and Buckhead submarkets, therefore it is suggested to expect asking rental rates to continue increasing in response.”

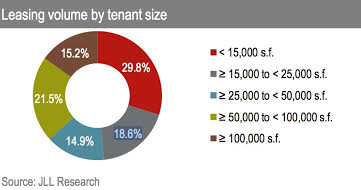

The main contributors of signed leases in the 3rd quarter were smaller firms inside the healthcare and professional business sectors. While the economy continues to recover firms are beginning to gain confidence; leaving temporary office space and opening branch offices. And in some cases starting new entrepreneurial business endeavors. To top off the small transaction activity are numerous expansions from larger firms adopting more space which will most likely be a sign for continued future office demand.

If you have any more questions regarding the lease or purchase of commercial property, please contact David Aynes at 404-348-4448.

If you have any more questions regarding the lease or purchase of commercial property, please contact David Aynes at 404-348-4448.

Atlanta Leasing & Investment is a boutique real estate firm offering equity investment and brokerage services in the metro Atlanta area. Since inception, Atlanta Leasing & Investment has acquired, leased and divested of over $450 Million worth of office, residential, industrial and retail properties. Our analysis will give you clarity in determining which deals to do – our experience will help ensure that you do them well. For more information, please visit www.atlantaleasing.com

All information is deemed reliable but not guaranteed.